Fujifilm — the clue is in the name, except it isn’t. Fuji was a behemoth in the film world, with Kodak its only rival. And then film went bust, and Kodak rapidly followed suit. Meanwhile, Fuji evaluated its business position and refocused principally around the healthcare sector and document management divisions. The architect of this remarkable turnaround was Chairman and CEO Shigetaka Komori. His retirement in March 2021 has precipitated changes that could have repercussions for its Imaging Solutions division.

In the mid-2000s, Komori implemented the VISION 75 management plan, which saw the business undertake structural reform and target new growth areas. The millennium saw a peak in revenue from film, but rapidly imploded thereafter, and Fuji knew they had to reduce production, which ultimately meant closing production facilities. As part of that process, they audited their existing technological expertise to see how they might align with different business sectors and markets. Once these were identified, they could focus their research and development in these areas. Healthcare was a prime target that integrated existing imaging and chemical expertise to target medical imaging and pharmaceuticals (where they already had a presence). The scale of the change was dramatic; Imaging Solutions (almost entirely film) made up 54% of revenue in 2001, dropping to 13% by 2021, while Healthcare now makes up 48%. Revenue is one thing; however, operating income gives a better idea of how a division is contributing to the bottom line. Healthcare comes in at 65%, while Imaging is 9.5%. It’s perhaps worth noting that, as a segment, Imaging is making money; there is nothing like a loss-making division to speed its closure!

Under Komori’s leadership, Fuji’s cameras have been favorably positioned within the business even if they haven’t generated significant revenue and income. New CEO Teiichi Goto took over the reins at Fuji in May, and we are already seeing signs that while he has inherited the same strategy from Komori, his focus may well be different and it’s possible that COVID has simply accelerated the shift that is becoming apparent.

Healthcare and Materials Solutions

It is notable that — to give it its full name — Healthcare and Materials Solutions was the only segment to see a rise in revenue in the previous financial year. The division represents three prongs of Fuji’s most successful business elements: medical diagnostics, pharmaceutical manufacturing, and materials for chipmakers. At this point, Bloomberg paints a bleak picture for the photography business, quoting Goto as saying:

Healthcare and semiconductor materials will be our future earnings drivers

This is unsurprising, as COVID has simply accelerated the importance of drug development and manufacturing, while also highlighting the fragility of the semiconductor sector, which interrupted chip manufacturing. Hired manufacturers in the semiconductor business are specialized and potentially lucrative work. Fuji is definitely in the right place at the right time.

Goto has been at Fuji for 40 years and worked in medical systems prior to taking the top job so is intimately acquainted with the business. However, he sees contract manufacturing as where lower-risk growth is attainable, both in the pharmaceutical and semiconductor businesses. As Reuters notes, as a contract development and manufacturing organization (CDMO), it would make pharmaceuticals for drug developers and mitigate the risk that it has seen trying to certify its own Avigan for COVID-19. Expanding in the US and Europe would be key to this development and it recently announced an $850 million investment in its US sub-division which is the spearhead of an $11 billion plan over the next 3 years.

Imaging Solutions

So, where is Imaging Solutions in all of this? The short answer is that it isn’t. When asked in a recent Asahi.com interview about Imaging Solutions specifically, he responded:

Regarding the film and camera business, he stated that he would continue without selling the business. “It is also a succession of culture and will continue. In ESG terms [Environmental, Social and Corporate Governance], it is S (contribution to society).”

While superficially heartening, it highlights the oddness of Fuji’s current business structure in which Document Solutions and Healthcare Solutions have had near equivalent revenue; last year, Healthcare edged ahead, and the expectation from Goto is that this is from where post-COVID growth will come. That Healthcare and Materials are grouped together — with Imaging left out on its own with just 13% of revenue — is an odd situation and a hangover from its film days. Imaging Solutions is now a small division in a very large business that only has three divisions in total. That it hasn’t merged with one of the other two divisions suggests that it is deliberately being kept separate.

Goto also suggests that the continued support for the Imaging Solutions division is because it is a part of their heritage and that it contributes to society. It does appear that history dies hard and that Imaging Solutions may well be a labor of love for Fuji, who can trace their film manufacturing heritage back to 1934 and camera manufacturing to 1948 (in the form of the Fujica Six). However, the division’s contribution to society does seem spurious; however, it is undeniable that it contributes to Fuji’s bottom line, and — unlike Nikon and (probably) Pentax — it isn’t losing money.

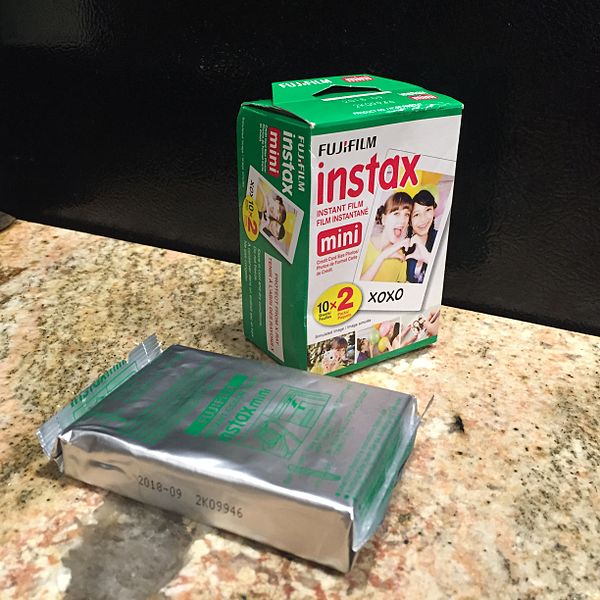

This only goes to highlight that Fuji is no longer primarily a camera company, even if the cameras themselves are modestly successful and make a profit. All of this suggests that if they pay their way, they will be welcomed as part of the Fuji family. That the X Series and G mount cameras are being actively developed is encouraging. In fact, of all the subdivisions in Imaging Solutions last year, Electronic Imaging suffered the smallest decline in revenue at 5%. However, perhaps the strangest — and most important — part of Fuji’s success strategy for Imaging is… film! As I’ve commented on before, Fuji sold 10 million Instax cameras in 2019, more than the whole digital camera industry sold in 2020! More importantly, Instax camera and film sales made up 9% of that 13% of Fuji revenue, with just 3% from its Electronic Imaging subdivision. Is digital really paying its way? Who knows, but as long as Fuji is structured in this manner — and they make money — it appears to be business as usual.

Lead image used under Creative Commons courtesy of Laura Ockel via Unsplash. Body image used under Creative Commons and courtesy of Mjdestroyerofworlds via Wikipedia.